This Time With Vengeance

Week of May 2nd, 2022

On-Chain Commentary

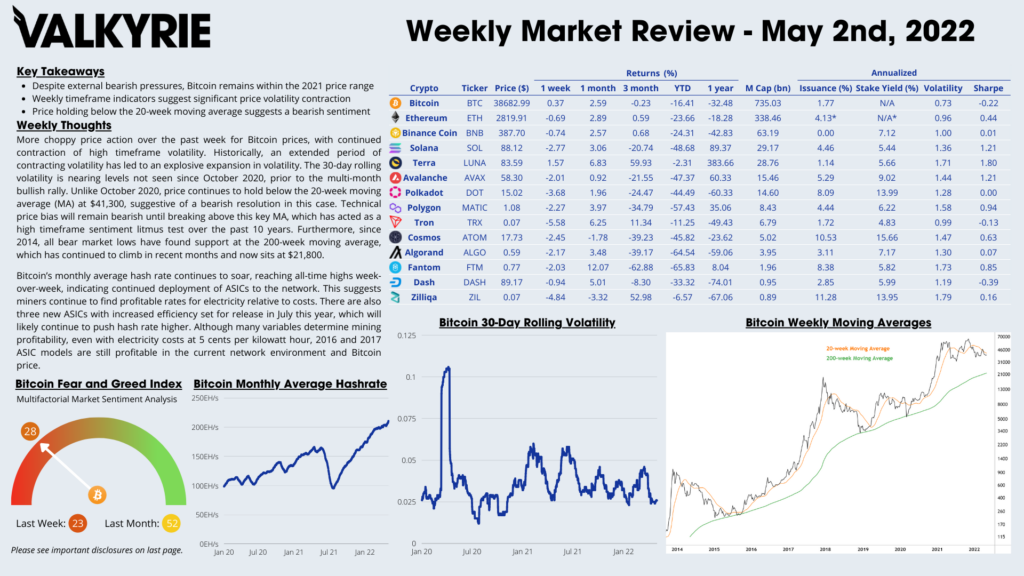

More choppy price action over the past week for Bitcoin prices, with continued contraction of high timeframe volatility. Historically, an extended period of contracting volatility has led to an explosive expansion in volatility. The 30-day rolling volatility is nearing levels not seen since October 2020, prior to the multi-month bullish rally. Unlike October 2020, price continues to hold below the 20-week moving average (MA) at $41,300, suggestive of a bearish resolution in this case. Technical price bias will remain bearish until breaking above this key MA, which has acted as a high timeframe sentiment litmus test over the past 10 years. Furthermore, since 2014, all bear market lows have found support at the 200-week moving average, which has continued to climb in recent months and now sits at $21,800.

Bitcoin’s monthly average hash rate continues to soar, reaching all-time highs week-over-week, indicating continued deployment of ASICs to the network. This suggests miners continue to find profitable rates for electricity relative to costs. There are also three new ASICs with increased efficiency set for release in July this year, which will likely continue to push hash rate higher. Although many variables determine mining profitability, even with electricity costs at 5 cents per kilowatt-hour, 2016 and 2017 ASIC models are still profitable in the current network environment and Bitcoin price.

Macro Commentary

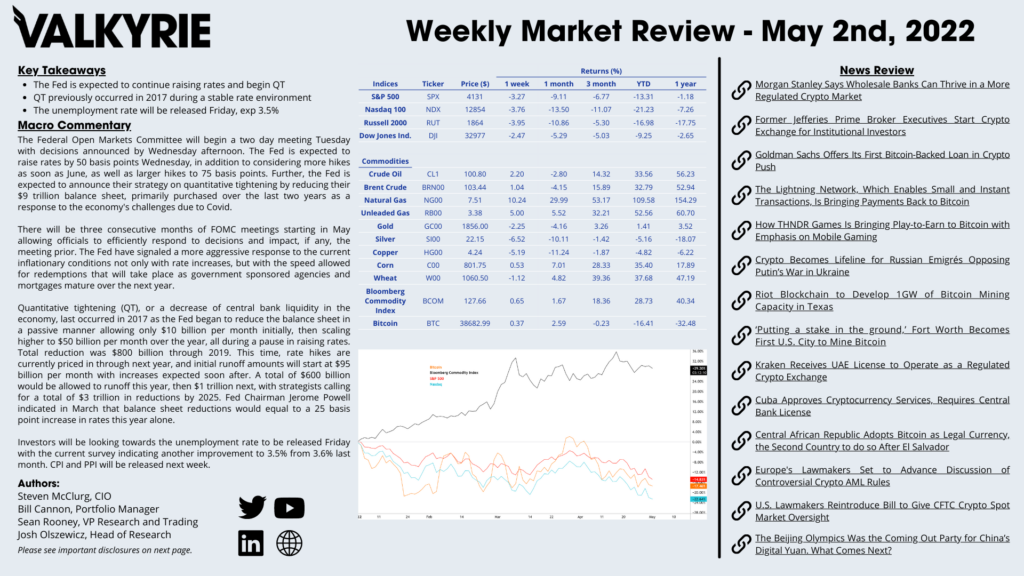

The Federal Open Markets Committee will begin a two day meeting Tuesday with decisions announced by Wednesday afternoon. The Fed is expected to raise rates by 50 basis points Wednesday, in addition to considering more hikes as soon as June, as well as larger hikes to 75 basis points. Further, the Fed is expected to announce their strategy on quantitative tightening by reducing their $9 trillion balance sheet, primarily purchased over the last two years as a response to the economy’s challenges due to Covid.

There will be three consecutive months of FOMC meetings starting in May allowing officials to efficiently respond to decisions and impact, if any, the meeting prior. The Fed has signaled a more aggressive response to the current inflationary conditions not only with rate increases, but with the speed allowed for redemptions that will take place as government-sponsored agencies and mortgages mature over the next year.

Quantitative tightening (QT), or a decrease of central bank liquidity in the economy, last occurred in 2017 as the Fed began to reduce the balance sheet in a passive manner allowing only $10 billion per month initially, then scaling higher to $50 billion per month over the year, all during a pause in raising rates. Total reduction was $800 billion through 2019. This time, rate hikes are currently priced in through next year, and initial runoff amounts will start at $95 billion per month with increases expected soon after. A total of $600 billion would be allowed to runoff this year, then $1 trillion next, with strategists calling for a total of $3 trillion in reductions by 2025. Fed Chairman Jerome Powell indicated in March that balance sheet reductions would equal to a 25 basis point increase in rates this year alone.

Investors will be looking towards the unemployment rate to be released Friday with the current survey indicating another improvement to 3.5% from 3.6% last month. CPI and PPI will be released next week.

Download the Full Weekly Market Review Here

The Portfolio Management Team

Steven McClurg, CIO

Bill Cannon, Portfolio Manager

Wes Cowan, Portfolio Manager, Head of Defi

Josh Olszewicz, Head of Research

Sean Rooney, VP Research and Trading

Will McDonough, Vice Chairman, Investment Committee

Leah Wald, CEO, Investment Committee

Shannon Smith, Head of Investor Relations