Effect of War

Week of February 28th, 2022

Main focus this week involves the continuous developments regarding the Russian attack on Ukraine. With initial attacks starting early Thursday morning in Ukraine, or later evening in the US, investors fled to safety with the 10 year dropping to 1.85% and the S&P 500 index declining to the 4100 level overnight. Front month crude oil futures rose to $100 but lowered as the trading day went on. Fortunately, most markets experienced a rebound to the start of the week levels by Friday afternoon, and now jump higher on any optimistic news related to a possible peaceful agreement.

Financial institutions worldwide are feeling the effect of war with sanctions placed almost daily now. Private and public financial ties with Russia have been investigated and closed in many cases, making it difficult for the Russian economy to operate somewhat normal over the past days. Recent events have also exposed many European countries on their current financial relationship with Russia, as well as their current energy dependency despite an ongoing strategy of using more renewables in the near term.

Back in the US, investors are waiting to see how this recent decline in markets will affect the Federal Reserve’s strategy combating inflation with bankers set to meet in March. Rate hike decisions this year could turn less aggressive due to the current situation, which could be embraced by the street.

On-Chain Update

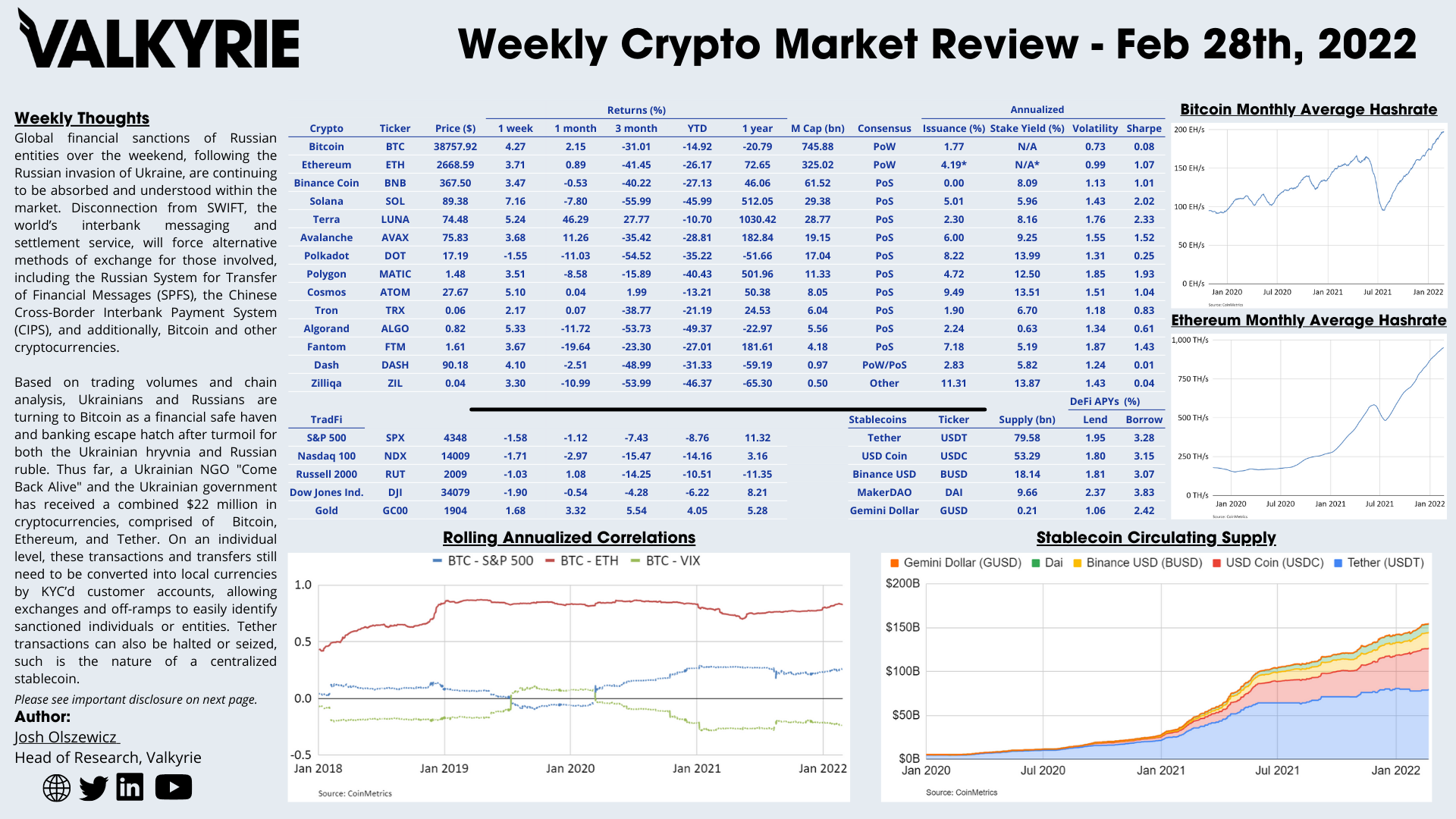

Global financial sanctions of Russian entities over the weekend, following the Russian invasion of Ukraine, are continuing to be absorbed and understood within the market. Disconnection from SWIFT, the world’s interbank messaging and settlement service, will force alternative methods of exchange for those involved, including the Russian System for Transfer of Financial Messages (SPFS), the Chinese Cross-Border Interbank Payment System (CIPS), and additionally, Bitcoin and other cryptocurrencies.

Based on trading volumes and chain analysis, Ukrainians and Russians are turning to Bitcoin as a financial safe haven and banking escape hatch after turmoil for both the Ukrainian hryvnia and Russian ruble. Thus far, a Ukrainian NGO “Come Back Alive” and the Ukrainian government has received a combined $22 million in cryptocurrencies, comprised of Bitcoin, Ethereum, and Tether. On an individual level, these transactions and transfers still need to be converted into local currencies by KYC’d customer accounts, allowing exchanges and off-ramps to easily identify sanctioned individuals or entities. Tether transactions can also be halted or seized, such is the nature of a centralized stablecoin.

Download the Full Weekly Market Review Here

The Portfolio Management Team

Steven McClurg, CIO

Bill Cannon, Portfolio Manager

Wes Cowan, Portfolio Manager, Head of Defi

Josh Olszewicz, Head of Research

Sean Rooney, VP Research and Trading

Will McDonough, Vice Chairman, Investment Committee

Leah Wald, CEO, Investment Committee

Shannon Smith, Head of Investor Relations