Market Volatility Here to Stay

Week of May 23rd, 2022

On-Chain Commentary

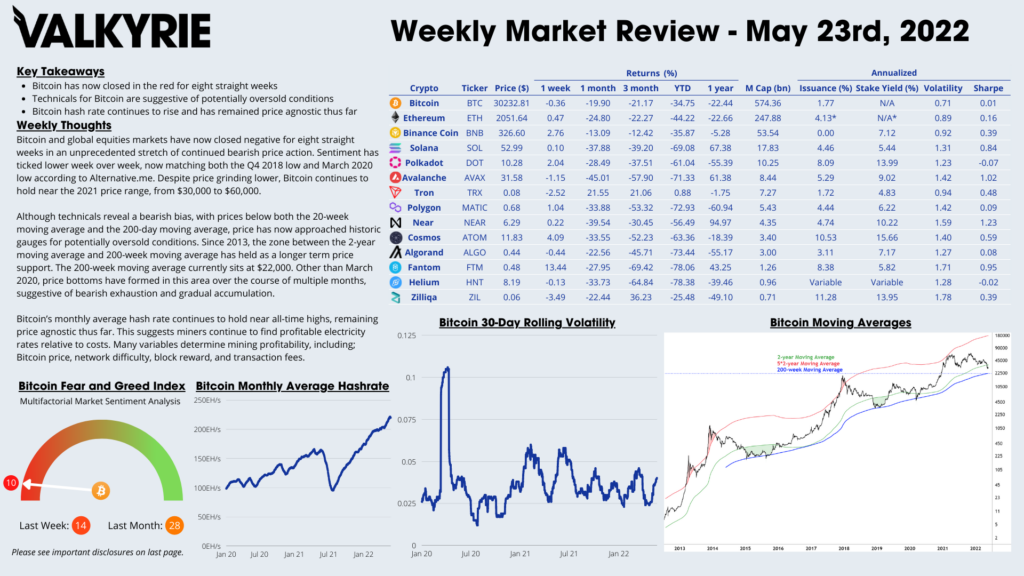

For the first time, Bitcoin has closed in the red for seven straight weeks as sentiment indicators also continue to hold near lows. Extreme fear, partially from the blowout of the Terra ecosystem, and associated forced selling to cover collateral requirements, have led to ongoing bearish price action. In the face of this, including heavily bearish price action in global equity markets, Bitcoin continues to hold near the 2021 price range. Although technicals show a bearish bias, with prices below both the 20-week moving average and the 200-day moving average, price has begun to approach historic gauges for oversold conditions. Since 2013, the zone between the 2-year moving average and 200-week moving average has held as price support. Other than March 2020, price bottoms have formed in this area over the course of multiple months, suggestive of bearish exhaustion and gradual accumulation.

Bitcoin’s monthly average hash rate continues to hold near all-time highs, remaining price agnostic thus far, suggesting miners continue to find profitable electricity rates relative to costs. Three new ASICs with increased efficiency are set for release in July this year, which will likely continue to push hash rate higher. Although many variables determine mining profitability, including Bitcoin price, network difficulty, block reward, and transaction fees, 2016 and 2017 ASIC models remain profitable at 5 cents per kilowatt hour.

Macro Commentary

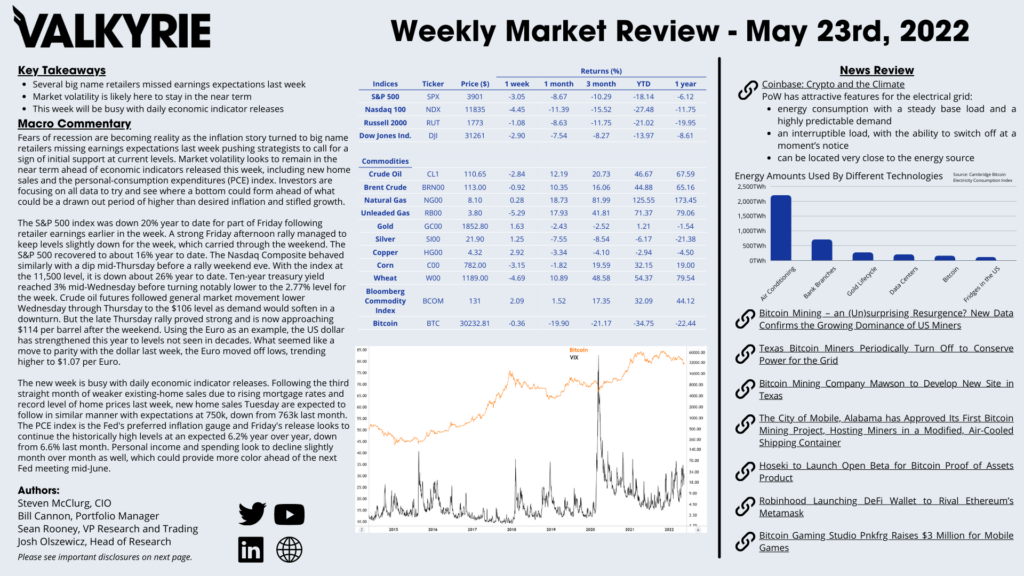

Fears of recession are becoming reality as the inflation story turned to big name retailers missing earnings expectations last week pushing strategists to call for a sign of initial support at current levels. Market volatility looks to remain in the near term ahead of economic indicators released this week, including new home sales and the personal-consumption expenditures (PCE) index. Investors are focusing on all data to try and see where a bottom could form ahead of what

could be a drawn out period of higher than desired inflation and stifled growth.

The S&P 500 index was down 20% year to date for part of Friday following retailer earnings earlier in the week. A strong Friday afternoon rally managed to keep levels slightly down for the week, which carried through the weekend. The S&P 500 recovered to about 16% year to date. The Nasdaq Composite behaved similarly with a dip mid-Thursday before a rally weekend eve. With the index at the 11,500 level, it is down about 26% year to date. Ten-year treasury yield reached 3% mid-Wednesday before turning notably lower to the 2.77% level for the week. Crude oil futures followed general market movement lower Wednesday through Thursday to the $106 level as demand would soften in a downturn. But the late Thursday rally proved strong and is now approaching $114 per barrel after the weekend. Using the Euro as an example, the US dollar has strengthened this year to levels not seen in decades. What seemed like a move to parity with the dollar last week, the Euro moved off lows, trending higher to $1.07 per Euro.

The new week is busy with daily economic indicator releases. Following the third straight month of weaker existing-home sales due to rising mortgage rates and record level of home prices last week, new home sales Tuesday are expected to follow in similar manner with expectations at 750k, down from 763k last month. The PCE index is the Fed’s preferred inflation gauge and Friday’s release looks to continue the historically high levels at an expected 6.2% year over year, down from 6.6% last month. Personal income and spending look to decline slightly month over month as well, which could provide more color ahead of the next Fed meeting mid-June.

Download the Full Weekly Market Review Here

The Portfolio Management Team

Steven McClurg, CIO

Bill Cannon, Portfolio Manager

Wes Cowan, Portfolio Manager, Head of Defi

Josh Olszewicz, Head of Research

Sean Rooney, VP Research and Trading

Will McDonough, Vice Chairman, Investment Committee

Leah Wald, CEO, Investment Committee

Shannon Smith, Head of Investor Relations