Russia-Ukraine Conflict

Week of February 21st, 2022

Escalations of the Russia-Ukraine conflict have continued to act as a catalyst, fueling risk-off capital rotations. The S&P 500 remains down 8.7% on the year while Gold holds a positive 4.0% year-to-date. The regional conflict has also affected energy markets globally, with Natural Gas and Oil rising to multi-month highs. At home, the battle against inflation also continues, with commodities like wheat, soybeans, and beef reaching multi-year or record highs. Treasury yields continue to hold early February highs with an upcoming Fed meeting in March. Market expectations are now pricing a 25 basis point increase in March, although this may continue to be adjusted with any further developments in the Russia-Ukraine conflict.

On-Chain Update

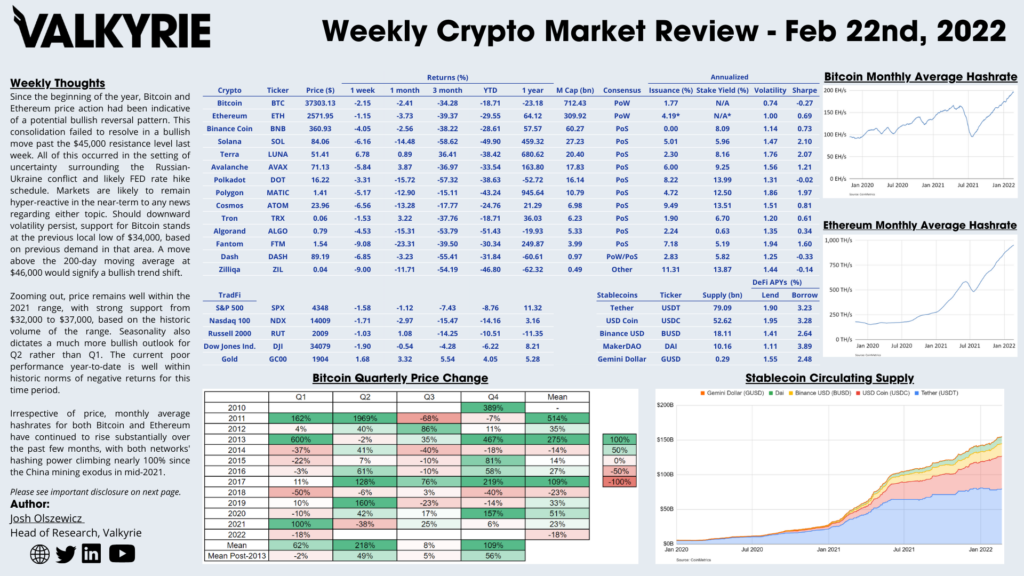

Since the beginning of the year, Bitcoin and Ethereum price action had been indicative of a potential bullish reversal pattern. This consolidation failed to resolve in a bullish move past the $45,000 resistance level last week. All of this occurred in the setting of uncertainty surrounding the Russian-Ukraine conflict and likely FED rate hike schedule. Markets are likely to remain hyper-reactive in the near-term to any news regarding either topic. Should downward volatility persist, support for Bitcoin stands at the previous local low of $34,000, based on previous demand in that area. A move above the 200-day moving average at $46,000 would signify a bullish trend shift.

Zooming out, price remains well within the 2021 range, with strong support from $32,000 to $37,000, based on the historic volume of the range. Seasonality also dictates a much more bullish outlook for Q2 rather than Q1. The current poor performance year-to-date is well within historic norms of negative returns for this time period.

Irrespective of price, monthly average hashrates for both Bitcoin and Ethereum have continued to rise substantially over the past few months, with both networks’ hashing power climbing nearly 100% since the China mining exodus in mid-2021.

Download the Full Weekly Market Review Here

The Portfolio Management Team

Steven McClurg, CIO

Bill Cannon, Portfolio Manager

Wes Cowan, Portfolio Manager, Head of Defi

Josh Olszewicz, Head of Research

Sean Rooney, VP Research and Trading

Will McDonough, Vice Chairman, Investment Committee

Leah Wald, CEO, Investment Committee

Shannon Smith, Head of Investor Relations