Will Digital Outperform Equities?

Week of May 16th, 2022

On-Chain Commentary

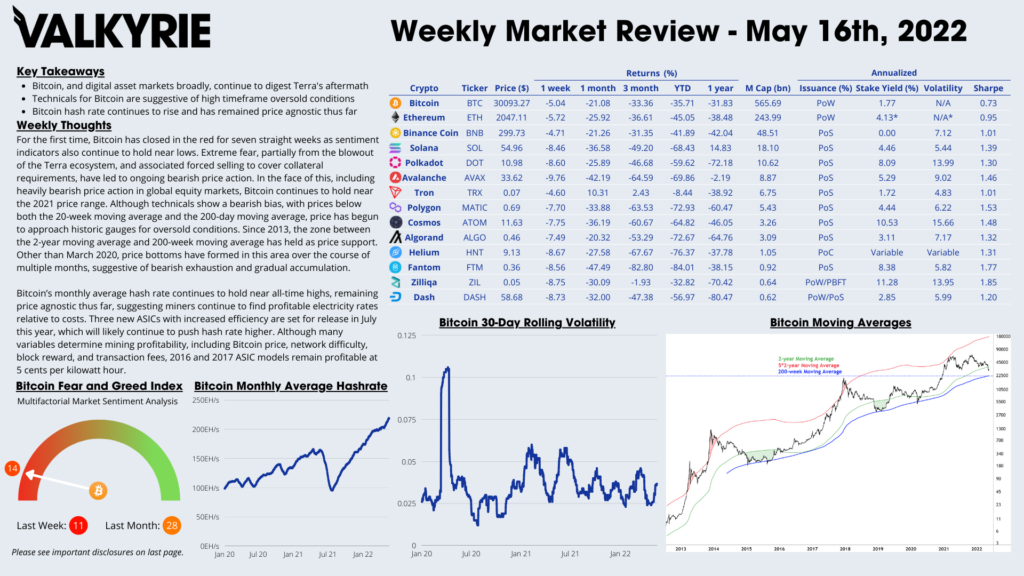

For the first time, Bitcoin has closed in the red for seven straight weeks as sentiment indicators also continue to hold near lows. Extreme fear, partially from the blowout of the Terra ecosystem, and associated forced selling to cover collateral requirements, have led to ongoing bearish price action. In the face of this, including heavily bearish price action in global equity markets, Bitcoin continues to hold near the 2021 price range. Although technicals show a bearish bias, with prices below both the 20-week moving average and the 200-day moving average, price has begun to approach historic gauges for oversold conditions. Since 2013, the zone between the 2-year moving average and 200-week moving average has held as price support. Other than March 2020, price bottoms have formed in this area over the course of multiple months, suggestive of bearish exhaustion and gradual accumulation.

Bitcoin’s monthly average hash rate continues to hold near all-time highs, remaining price agnostic thus far, suggesting miners continue to find profitable electricity rates relative to costs. Three new ASICs with increased efficiency are set for release in July this year, which will likely continue to push hash rate higher. Although many variables determine mining profitability, including Bitcoin price, network difficulty, block reward, and transaction fees, 2016 and 2017 ASIC models remain profitable at 5 cents per kilowatt hour.

Macro Commentary

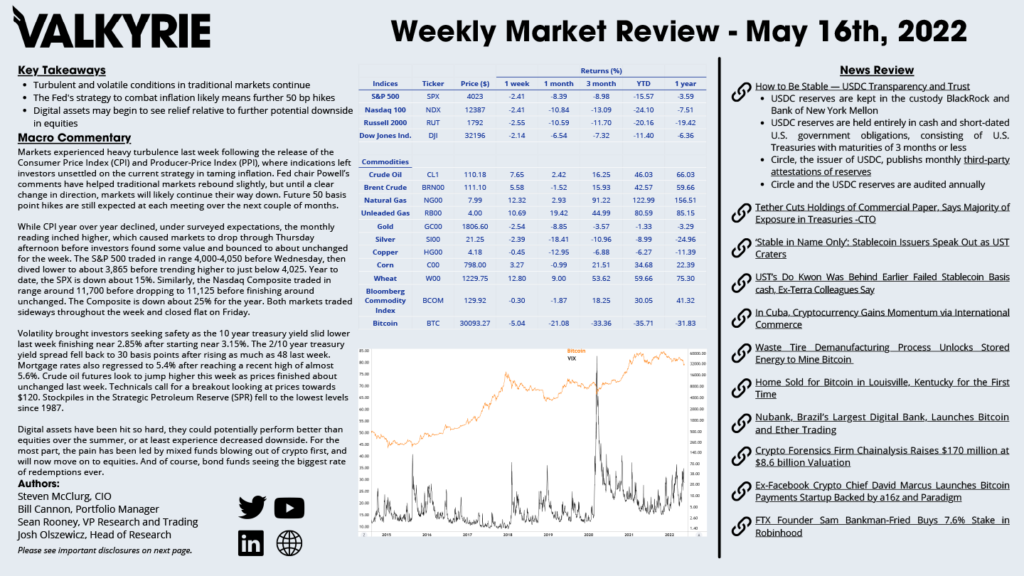

Markets experienced heavy turbulence last week following the release of the Consumer Price Index (CPI) and Producer-Price Index (PPI), where indications left investors unsettled on the current strategy in taming inflation. Fed chair Powell’s comments have helped traditional markets rebound slightly, but until a clear change in direction, markets will likely continue their way down. Future 50 basis point hikes are still expected at each meeting over the next couple of months.

While CPI year over year declined, under surveyed expectations, the monthly reading inched higher, which caused markets to drop through Thursday afternoon before investors found some value and bounced to about unchanged for the week. The S&P 500 traded in range 4,000-4,050 before Wednesday, then dived lower to about 3,865 before trending higher to just below 4,025. Year to date, the SPX is down about 15%. Similarly, the Nasdaq Composite traded in range around 11,700 before dropping to 11,125 before finishing around unchanged. The Composite is down about 25% for the year. Both markets traded sideways throughout the week and closed flat on Friday.

Volatility brought investors seeking safety as the 10 year treasury yield slid lower last week finishing near 2.85% after starting near 3.15%. The 2/10 year treasury yield spread fell back to 30 basis points after rising as much as 48 last week. Mortgage rates also regressed to 5.4% after reaching a recent high of almost 5.6%. Crude oil futures look to jump higher this week as prices finished about unchanged last week. Technicals call for a breakout looking at prices towards $120. Stockpiles in the Strategic Petroleum Reserve (SPR) fell to the lowest levels since 1987.

Digital assets have been hit so hard, they could potentially perform better than equities over the summer, or at least experience decreased downside. For the most part, the pain has been led by mixed funds blowing out of crypto first, and will now move on to equities. And of course, bond funds seeing the biggest rate of redemptions ever.

Download the Full Weekly Market Review Here

The Portfolio Management Team

Steven McClurg, CIO

Bill Cannon, Portfolio Manager

Wes Cowan, Portfolio Manager, Head of Defi

Josh Olszewicz, Head of Research

Sean Rooney, VP Research and Trading

Will McDonough, Vice Chairman, Investment Committee

Leah Wald, CEO, Investment Committee

Shannon Smith, Head of Investor Relations