Subscribe to our

research newsletters

"*" indicates required fields

Bitcoin’s on-chain activity has picked up in recent weeks, thanks to growing utility in emerging markets and the rise of NFT novelty. Both transactions...

Bitcoin will likely close at least +40% on the month, a rare feat for January, historically. This will also likely be Bitcoin’s strongest monthly performance since late 2020. Longer term Bitcoin monthly...

Bitcoin is now +37% YTD, outperforming the S&P 500 by a factor of 10x. Now with both the FTX debacle and tax loss harvesting in the rearview, sentiment...

As the S&P bulls were celebrating another attempted breach of 4k last week, Bitcoin and other digital assets were off to the races.

Markets welcomed some fresh air to start the year with a robust jobs number Friday as the unemployment rate declined slightly to 3.5% from November's...

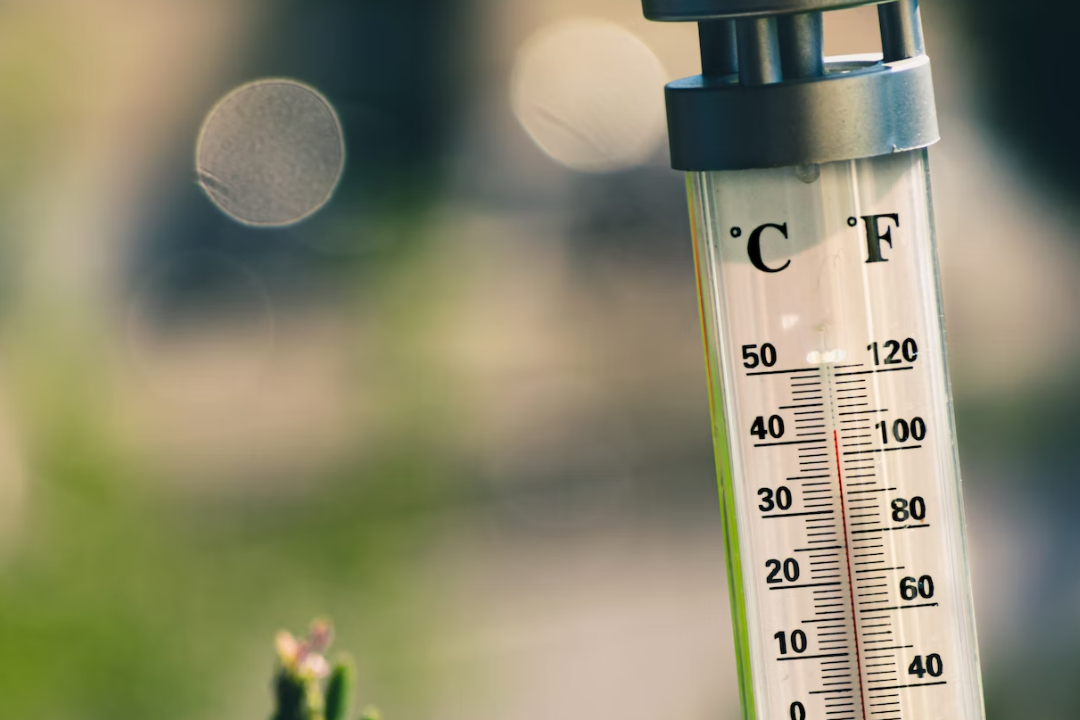

Investors celebrated the New Year by raising a glass to the conclusion of a difficult 2022, where controlling inflation dominated economic activity and...

Once again, markets experienced volatility following a FOMC rate decision when the message remains the same on what needs to be done to combat the...

Investors have waited patiently for the last economic indications of the year with the November CPI print to be released Tuesday, then the FOMC rate...

US economic data, including initial jobless claims and freight shipping costs, has continued to reveal signs of generalized post-pandemic slowing...

Post-pandemic and stimulus slowdown indications continue to mount. Rising rates and mortgage costs have crushed YoY home sales, which are now at lower...

The latest inflationary indications released last week provided some relief for investors hoping for a more passive rate hike strategy in the near term...

Last week confirmed the Fed is in the driver's seat and in control of what direction comes next. Investors were hopeful on some type of indication for a...

Optimism may be slowly spreading. Markets experienced a rally reacting to indications that the Fed's strategy in raising rates to tame inflation may be...

The end of last week sparked some optimism as Fed officials indicated rate hikes could significantly slow down or even end after the next round...

Last Thursday's CPI numbers rocked markets, spreading volatility across all sectors. While CPI year over year declined slightly to 8.2%, monthly numbers...

Volatility took center stage last week following a slow and steady rally based on the belief that economic tightening could be gradually ending...

Strong storms rattled markets last week as investors were still breaking down the repetitive hawkish comments by the Fed. The Bank of England also moved world markets Wednesday as it intervened in buying government debt...

Seems like the Fed has hit the repeat button every time a meeting comes up, and investors don't like it. Markets were range bound last week prior to the Fed's decision Wednesday, expecting a 75 bp hike and more of the same hawkish comments conveyed....